A 3 Step Financial Wellness Program That Reduces Stress and Anxiety

Refresh your finances and release the financial pressure in your life with this easy and fun 42 day wellness program

Sometimes it feels impossible to shake those money blues

You are not alone.

You want to be amazing at work and you have goals and dreams of a bright future.

But no matter how many hours you commit to being better at your career and your finances, the problem of money management is a constant distraction, and post covid, it’s just getting worse.

The Serious Consequences Of Poor Financial Health

Your Health

Ongoing financial concerns can cause insomnia, weight gain, headaches, high blood pressure and a range of unhealthy coping mechanisms such as drinking too much, smoking more and even illegal drug use.

Your Feelings

Financial difficulties can cause stress, anxiety, depression, regret, shame, social withdraw, relationship and dating difficulties, family issues, self esteem issues, lack of goals, burnout and can even lead to thoughts of self harm or suicide.

Your Career

Workers dealing with tough financial situations are far more distracted and often use office hours to address or worry about their financial issues. They are more inclined to take sick days and even consider workplace theft.

Fast Track Your Financial Wellness!

Imagine that in just 42 days from today you could have your money permanently under control, forever.

Imagine a simple solution that can:

✔️ Remove the confusion and stop the pain in less than 1 hour

✔️ Identify the cause and wipe away the regret in less than a week

✔️ Upgrade your money mindset and reset your spending habits in seconds

✔️ Automate your money management in a free and fun way

✔️ Monitor your growing net worth and keep you on track for your financial goals

✔️ All while allowing you to continue living the life you enjoy and even giving you permission to have MORE fun!

This is The Money Well Masterclass

It’s not an app. It’s not a budget or planner. It’s a financial wellness program that's got your back while you work, play and sleep.

Permanently.

The 3 key elements of a successful personal finance wellness solution

Choose Your Expert

Just like confession at church, I believe the best way to insight change is to open up and share your truth with someone you trust.

An honest and open reality check. So you can start fresh.

Identify Patterns

I don’t care how complex you think your situation is. There are patterns, habits and embedded beliefs that are unique to you and your life.

With a little skilled analysis, these can be identified and recorded.

Implement Change

And I don’t just mean to talk about it. I mean being held accountable and tracking your progress with support.

Like weekly check-ins with a doctor or personal trainer. Track the data and pretty soon you’ll be seeing the evidence and feeling great.

Ready to get started?

Fast Start NowI use a simple framework that has been tried and tested over many years with hundreds of people

Michael Misseur, Darwin

“With a dual career as a pilot and a DJ, managing my money so I could save for a house deposit used to be such hard work. 18 months into Stacys system and I’ve bought the house and am in control of my spending habits like never before. It’s made a huge difference to the way I see saving and my whole future to be honest. Thanks Stacy”

Chris Sulfa, Newcastle

“I’ve got 2 little kids and 2 jobs. My wife and I both use Stacys banking structure because we saw one of his presentations years ago at a venue I used to run. Honestly I can’t imagine what my life would have been like these past few challenging years if we didn’t have the clarity on our money that his system has given us. It’s scary to think, especially when I consider what that could have meant for the kids.”

Kirsty Carr, Bondi

"One of my best friends sent me to work with Stacy because I was so desperate to leave my job but was terrified about the financial side of doing it. Getting super clear on my money helped me not only change jobs, but I also achieved a huge pay increase because I was so clear on what I needed vs what I felt I wanted. Epic ROI! Thanks Stace!"

Jeffrey Messina, Bondi Beach

“I’ve been a school teacher for 15 years and what impressed me most about what Stacy has given me is it’s simplicity. I wish this kind of money management was normal and actually taught in schools. We would all be much better off.”

Benny Brooks, Bondi Junction

"I’d tried a bunch of money coaches before I worked with Stacy. He didn’t muck around and told me what I needed to hear straight away haha. I’ve now smashed my credit cards in crazy fast time and am now on target to crack my first $10k in savings. Sometimes it’s best to work with a street smart kinda guy than some office nerd who’s always trying to say the right things and be nice."

Greer Boase, Perth

"Stacy’s a legend and he’s on your side. I basically force all of my friends to do his program now. I hate seeing people waste their life being sad about money. It’s not necessary at all."

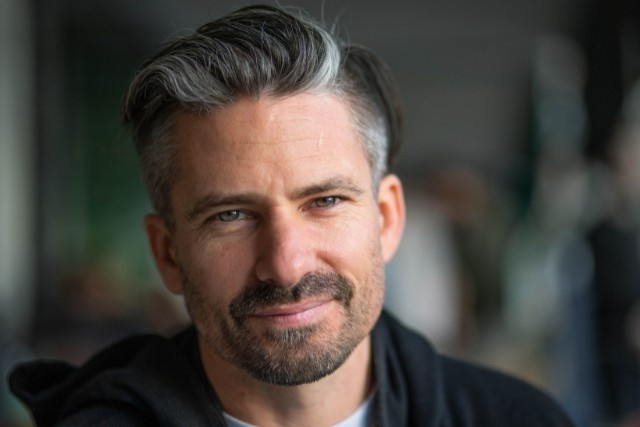

Hi, I'm Stacy

From rags to riches, kinda

I used to be terrible with my money. Like most people I guess.

I’m from a really poor family and never got any kind of financial education. Well, except for the poor mans mindset of course!

Sure I would read books on personal development and becoming and entrepreneur, but I was constantly living week to week and running out of money.

My beautiful renaissance

At the age of 28 I did some serious work on my life. I stopped blaming everyone else for my problems and took responsibility for my situation and all my flaws.

I worked hard on myself for 3 long years. I set amazing goals and made a vision board.

Before I knew it I was at the top of my promo modelling industry and my income had reached $1,500 per week. (for me that was amazing!)

Epiphany #1: I was broke

I’d started a side hustle teaching new ABN holders how to manage their little businesses. Part of that training was a simple excel spreadsheet where all the business incomes and expenses could be tracked. (This is the original old spreadsheet from 2008)

Then one day I had epiphany #1!

What if I applied this spreadsheet to my personal finances?

I got a massive wake up call

Although I was doing pretty well in my business, it turned out I was going backwards at an alarming rate! Within 1 month of this discovery I had moved out of my fancy apartment and into a share house bunk room that smelled like socks.

I smashed my living costs by 60%.

In addition, I was firmly committed to the golden rule of money - to save 10% of everything I earned. With the chaos of my banking scenario, that was a very time consuming weekly process.

There had to be a better way!

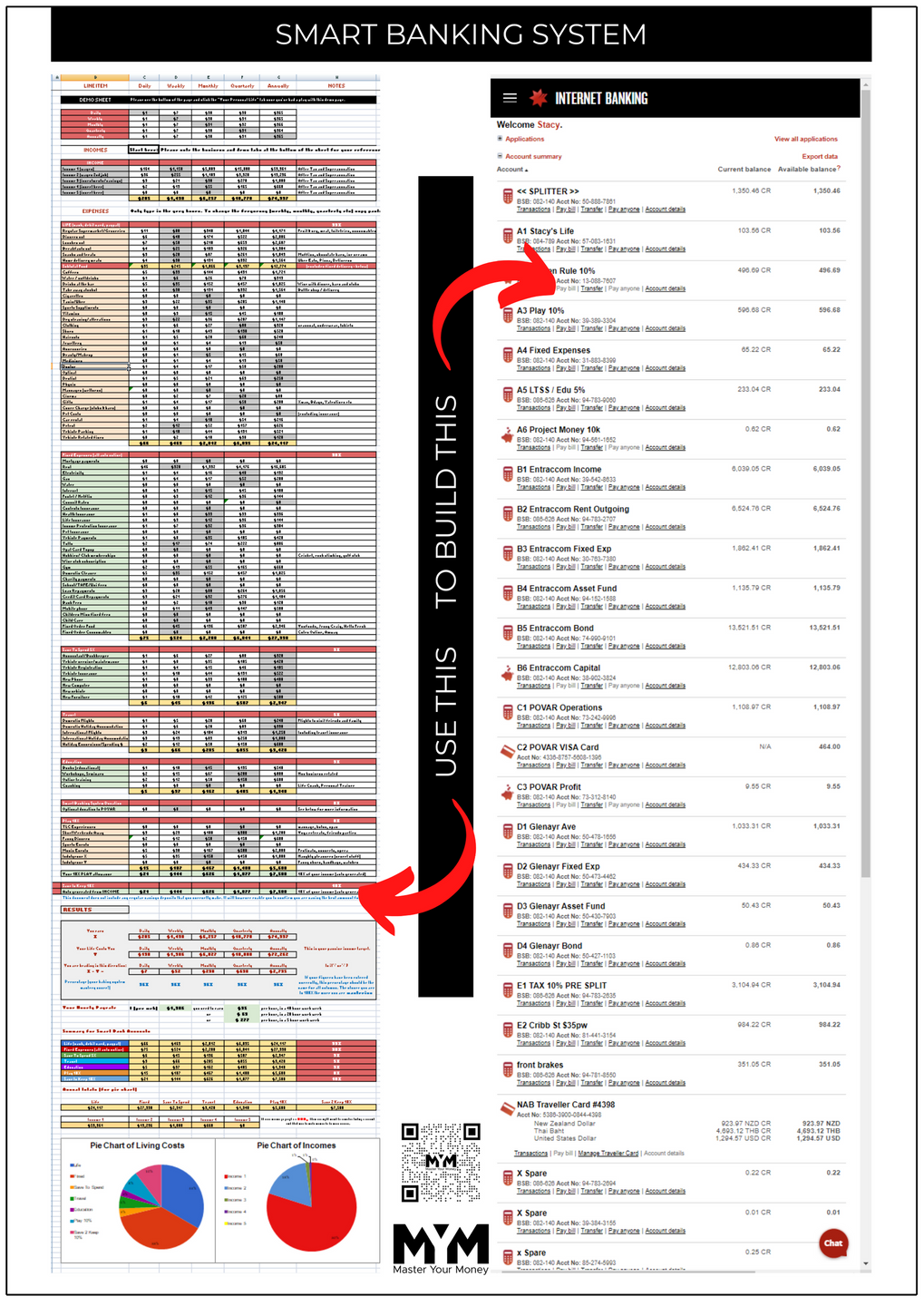

Epiphany #2: Smart Banking System

This was epiphany #2. I split all of my income and expenses into 15 different automated bank accounts.

BOOM! It was game on! I could suddenly forget about my money management and focus on scaling my businesses!

By the time I was 33 my side hustles and Smart Banking System enabled me to stop working full time. And by the time I was 35, I was getting paid to travel the world while the banking system managed 2 significant businesses for me.

Epiphany #3: I have to help others

I was a free man in the prime of my life.

Everyone asked me how I did it. I told them it was 2 things: Having a business and setting goals. It was the Smart Banking System that made it all possible.

Of course they wanted me to show them how. So I started teaching my method in workshops all over Bondi.

Semi retired for 15 years!

Not only did I stop working at 33, but I also got to retire my mum from the toughest job in the world and pay off her mortgage.

I got to show thousands of amazing people in my community how to build a better life.

Nowadays I run webinars and workshops where I get to share this life changing solution with people all over Australia.

I feel like I’m one of the luckiest men on earth.